RISX: ICMR (Re)Insurance Specialty Index

Insurance Capital Markets Research

About the ‘RISX’ Index

The RISX index is the first equity benchmark that focuses on the global specialty (re)insurance sector.

Specialty (re)insurance is a discrete and important subset of both non-life insurance and wider financial services. A selected group of global (re)insurance carriers offer specialty (re)insurance, most of them underwrite a wide portfolio of risks to achieve diversification and capital efficiency. That’s why there is no standardised classification of such companies.

The centre of the global specialty (re)insurance syndication is the Lloyd’s of London marketplace. The performance of Lloyd’s is seen as a benchmark for the industry. Businesses operating at Lloyd’s all report their accounts in a consistent, prescribed way, facilitating analysis and making Lloyd’s a fractal of the global specialty (re)insurance industry. Furthermore, Lloyd’s has announced detailed ESG reporting requirements to be implemented across the market from 2023.

The RISX index is based on the listed companies that participate in Lloyd’s, which account for over ⅔ of Lloyd’s premium, and underwrite over 25% of all global non-life (re)insurance premiums (c.USD 500Bn part of USD 1.8Trn annually).

The RISX constituents are premium weighted in the index, not market capitalisation weighted, to better replicate the underlying risk profile of specialty (re)insurance. This produces an index with currently 30 constituent companies based across the globe that mimics the risk profile of Lloyd’s.

The index was created by Insurance Capital Markets Research (ICMR), the analytic and consulting firm created by the former heads of research and analysis at Lloyd’s.

Two versions of the RISX index are calculated daily by Morningstar Indexes GmbH, a price return index (ticker: ‘RISX’) and a net total return index (ticker: ‘RISXNTR’). The index is available via the usual platforms, such as Bloomberg, Refinitiv, and www.risxindex.com.

About Specialty (Re)insurance

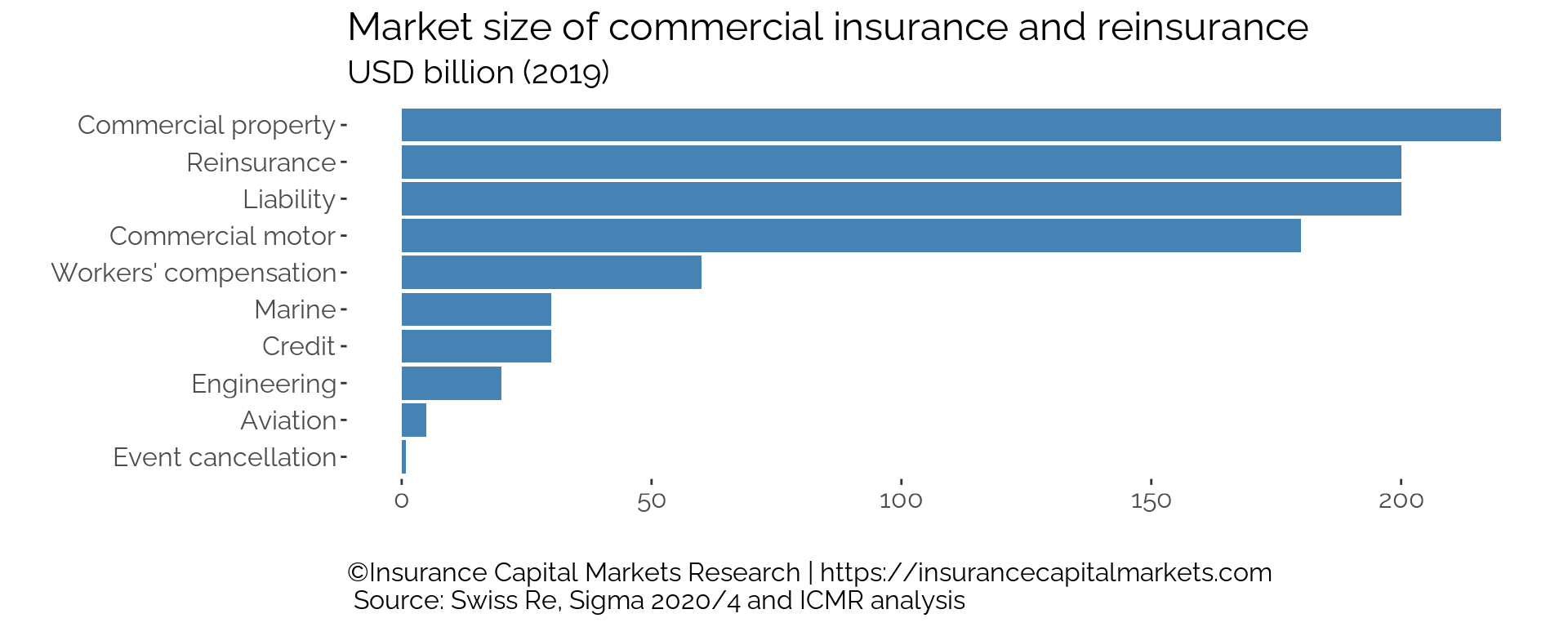

Specialty (re)insurance focuses on large and complex risks, principally commercial property, infrastructure, transport and liability risks. It also encompasses reinsurance, which is the protection insurance companies themselves purchase to reduce their aggregation risk from catastrophe, e.g. from hurricane damage claims.

A selected group of global (re)insurance carriers offer specialty (re)insurance, most of whom underwrite a wide portfolio of risks to achieve diversification and capital efficiency. The Lloyd’s of London market is the global centre of specialty (re)insurance and the syndication of risk amongst many (re)insurance carriers.

Climate change and the transition to net-zero require significant investments and changes to global energy supplies, infrastructure and trade. The global specialty (re)insurance industry with its ability to model natural catastrophes and syndicate risks will be central to achieve the net-zero goals. Swiss Re estimated that premiums for non-life insurance will double by 2040 to USD 4Trn.

Figure 1: The global premium income for commercial insurance and reinsurance is c.USD 1.0 trillion, of which the RISX index components write c.USD 500 billion annually

Specialty (re)insurance business tends not to behave like a retail insurance business with its large, homogeneous groupings of broadly similar risks, e.g. home or motor policies. The underwriting result of specialty (re)insurance business is more volatile given the fortuitous nature of larger claims and natural catastrophes

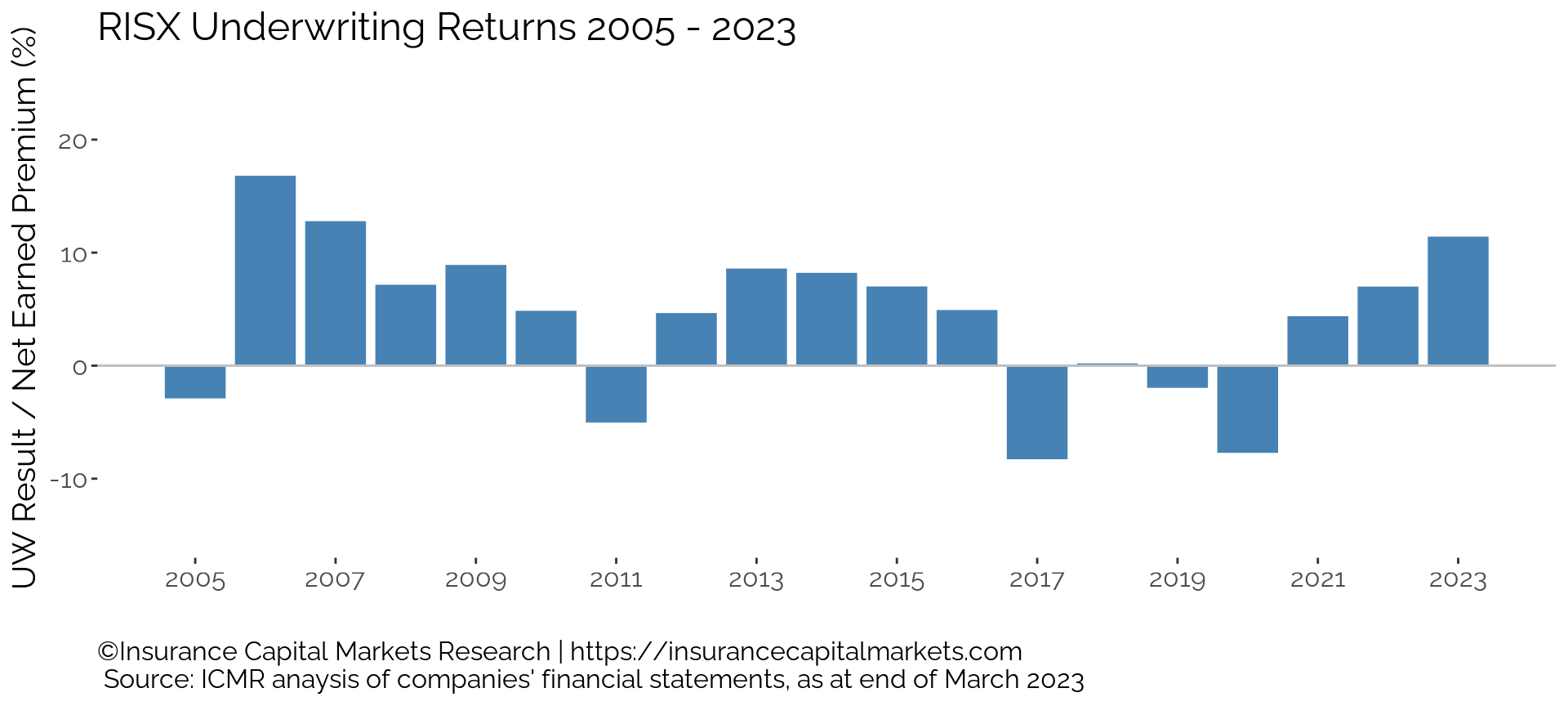

The profitability of specialty (re)insurance underwriting is driven by both premium pricing levels and the frequency/severity of catastrophe claims activity. When premium pricing levels are generally high (a hard market), even the occurrence of some severe catastrophe claims will not prevent overall profitability. When premium pricing levels are generally low (a soft market), the absence of catastrophe claims can still lead to profitable outcomes. However, the occurrence of catastrophe claims in a soft market can compound capital destruction and balance sheet weakening.

Figure 2: Underwriting return of the aggregated RISX index companies. Years with major catastrophes: 2005 (Hurricanes Katrina, Rita, Wilma), 2011 (Canterbury EQ, NZ; Tohoku EQ & tsunami, Japan), 2017 (Hurricanes Harvey, Irma, Maria), 2018 (Hurricanes Michael and Florence, Typhoons Jebi and California wildfires), 2019 (Typhoon Hagibis, Faxai, California wildfires), 2020 (COVID, Hurricane Laura)

Successful specialty (re)insurance underwriters tend towards a diversified portfolio of risks, backed up by continual modelling of potential impacts from theoretical catastrophe claims events. This enables them to understand their balance sheet exposures in real time. Because many of the risks underwritten are so large and complex, the vast majority are underwritten by more than one specialty (re)insurance company - the so-called subscription market model. One company will price the whole risk and will then underwrite a percentage of it, the remainder being submitted to other specialty (re)insurance companies to follow with smaller percentages on the same terms. In this way, large risks can be underwritten in their entirety by a group of specialty (re)insurance companies, not leaving the insurance buyer overly exposed to just one such company. It also means that, over time, differences in underwriting performance between specialty (re)insurance companies exhibit more gradual shifts than sharp swings. This is because these companies often share the same risks year after year.

In recent years, these companies’ appetite for certain exposures has been outstripped by the appetite of certain capital markets investors keen to access cash flows from specific risks. These relate principally to catastrophe bonds.

Many specialty (re)insurance companies hedge their own risk through issuing catastrophe bonds in the growing Bermuda catastrophe bond market, a market of over US$100bn of exposure limits. This makes many specialty (re)insurance companies both aggregators of risk and traders of risk. Capital markets investors’ interest in these types of specialty (re)insurance risk is driven by it generally being seen as a diversified asset class with lower correlation to investment market risk. Even the RISX index, itself a pure equity index, has a lower correlation with market risk than other financial service or wider insurance equity indices.

More comprehensive contextual analyses of specialty reinsurance performance can be found in the S&P Global Reinsurance Highlights Report. Those for specialty insurance can be found in the Deloitte Insurance Industry Outlook.

About Lloyd’s of London

Lloyd’s is a marketplace that over its 330+ year history has been the centre of innovation in specialty (re)insurance. It is the silicon valley of insurance. Lloyd’s was the first to insure cars (ships navigated on land), planes and satellites, more recent product innovation have been around cyber insurance, the transport of Covid vaccines and dedicated ESG underwriting.

Lloyd’s often leads the industry. Its annual premiums are in excess of £35bn (US$50bn) and it sets global pricing on specialty risk many times this amount. Lloyd’s is a founding member of ClimateWise to analyse the impact of climate change, it has set industry standards for realistic disaster scenarios, price monitoring and is now working towards consistent ESG reporting.

Over its history Lloyd’s has established a globally recognised brand with a reputation to pay all valid claims, it has licenses to do business in more than 200 countries and a network of brokers and experts to underwrite the most complex and large risks. It allows for capital efficient underwriting, thanks to its set up as a marketplace of individual businesses under a mutual brand and rating.

That’s why many global specialty (re)insurance companies have invested in subsidiaries in this unique marketplace.

Today, the majority of Lloyd’s regulated businesses are owned by publicly listed global insurance and reinsurance companies, and some own more than one Lloyd’s regulated business. Lloyd’s, through its position in the London insurance market, remains a strategically important platform in these companies’ global operations.

Direct capital investment in Lloyd’s is a heavily regulated activity with a number of strict requirements to fulfil as well as the cost of entry. Lloyd’s has provided attractive and diversifying returns to many of those investors who have had the resources and time to become regulated Lloyd’s members (Names). However, invested capital can remain at risk for a number of years even after active investment at Lloyd’s has ceased.

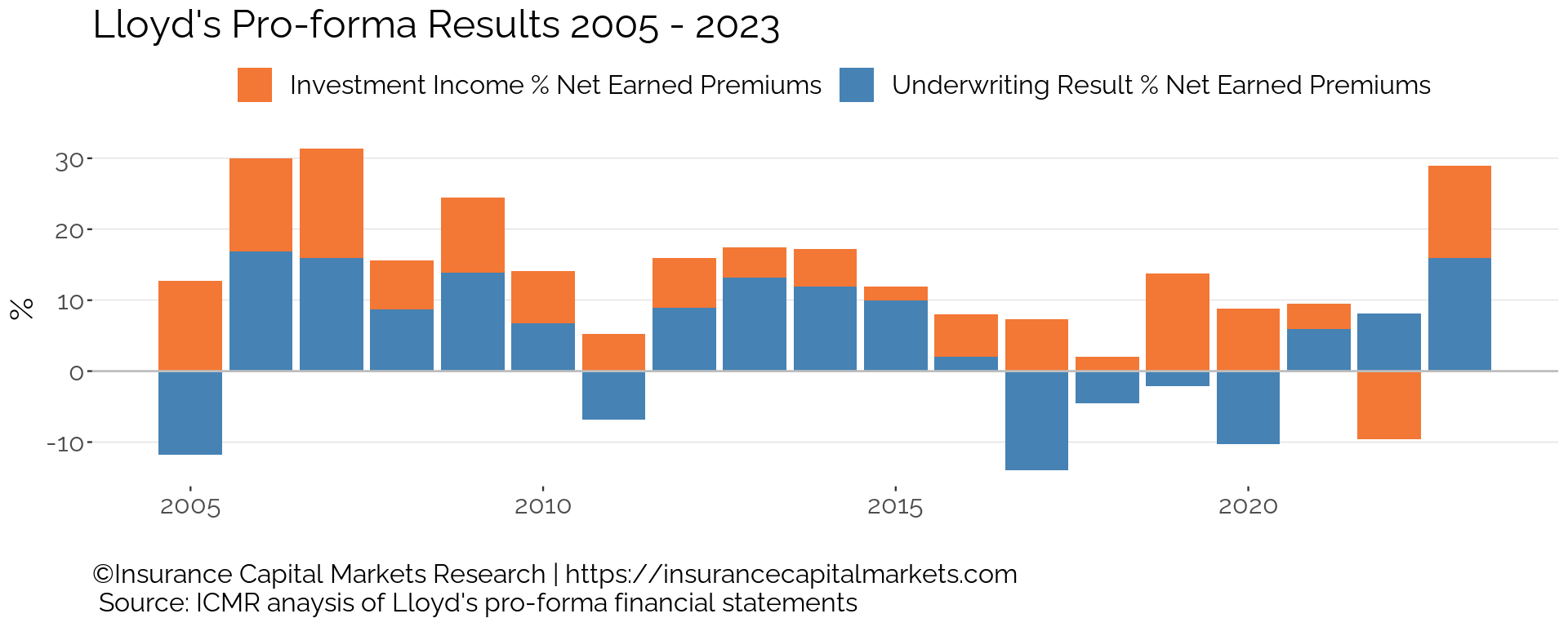

Both underwriting and investment income contribute to Lloyd’s performance. Investment income compensated for some of the underwriting losses due to catastrophes in 2005 (Hurricanes Katrina, Rita, Wilma), 2011 (Tohoku earthquake and floods in Thailand), 2017 (Hurricanes Harvey, Irma and Maria), 2018 (Hurricanes Michael and Florence, Typhoons Jebi and California wildfires), 2019 (Typhoon Hagibis, Faxai, California wildfires), 2020 (COVID, Hurricane Laura).

The heavily regulated nature of specialty (re)insurance in general, and the Lloyd’s of London market in particular, requires changes of ownership of businesses at Lloyd’s to be vetted and approved. Planned growth within Lloyd’s must also be approved, as Lloyd’s seeks to protect its brand, financial strength rating and global network of licences.

Since 2003, Lloyd’s internal performance management directorate has monitored the performance of the marketplace closely and controls who can own a Lloyd’s business, who can start a business and who can grow its business. This approach has attracted and encouraged more professional global insurance businesses to participate and invest in the Lloyd’s market.

Further information on Lloyd’s of London, its history, performance and regulation can be found at www.lloyds.com.

Index Characteristics

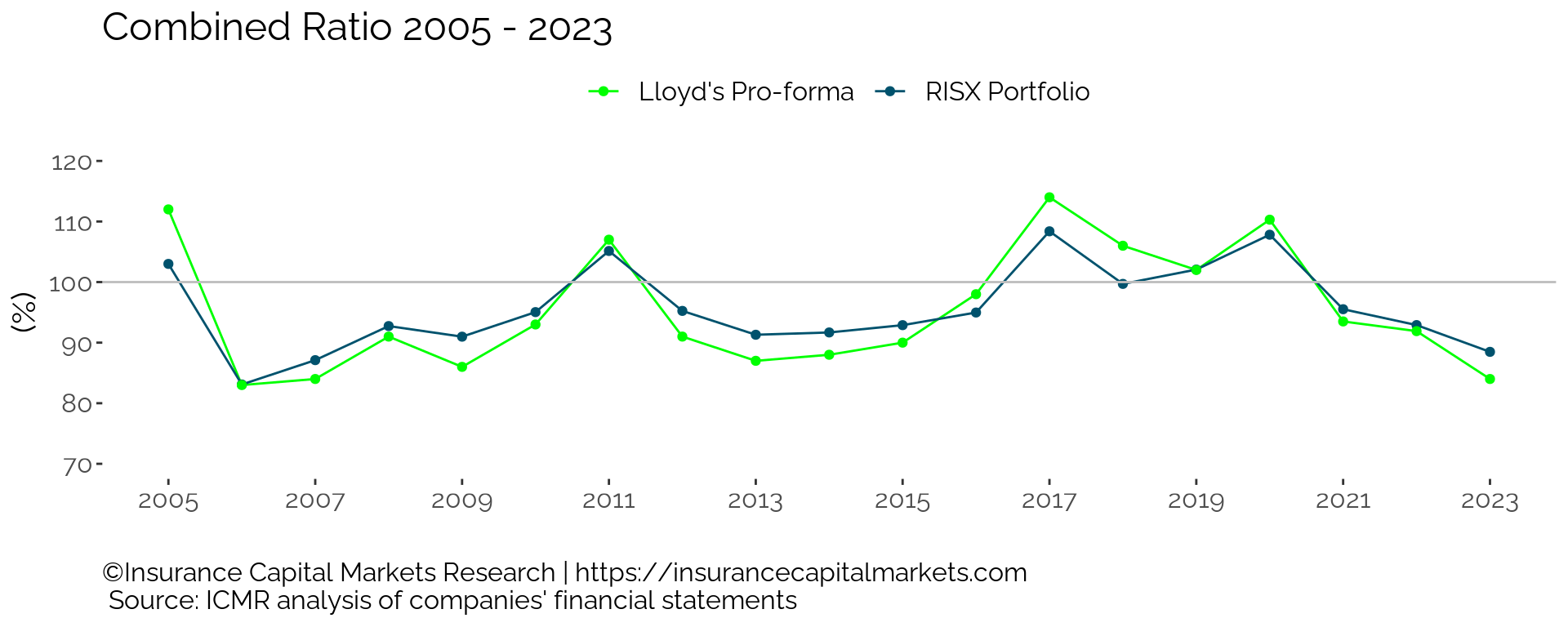

The following chart compares underwriting performance of the RISX index against the reported Pro-Forma aggregate of the Lloyd’s of London market. The metric used is the insurance industry standard metric of combined ratio, which comprises the total calendar year claims plus the total calendar year costs (both business acquisition costs and operating expenses) divided by the calendar year premium receipts.

The above chart shows the similarity in combined ratio performance of the reported Pro-Forma aggregate Lloyd’s of London market over the last 15 years when compared to the backtest of the RISX index. This is not surprising, given the existence of the subscription market, mentioned in “About Specialty (Re)insurance”, where multiple specialty (re)insurance companies share different percentages of the same risks, whether through their Lloyd’s of London subsidiaries or otherwise, year after year.

The peaks in the chart correspond with years in which there were significant catastrophe claims - 2005 hurricanes Katrina, Rita and Wilma; 2011 Chile earthquake; Thailand floods and Fukushima earthquake/tsunami; 2017 hurricanes Harvey, Irma and Maria; 2020 hurricane Laura and COVID.

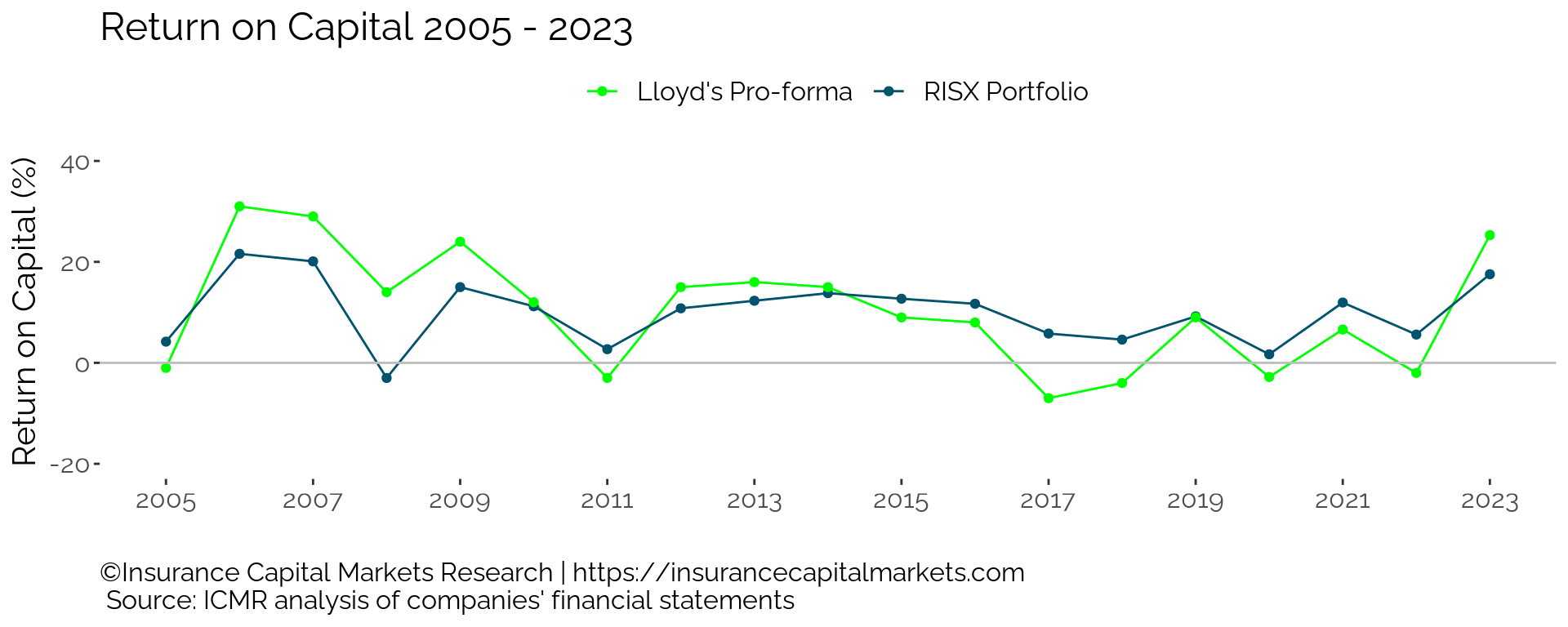

Given the similarity in combined ratios, the RISX index also shows similar return on capital characteristics to the reported Pro-Forma aggregate Lloyd’s of London market over a similar time period.

The above chart shows the comparable returns on capital for the RISX index and the aggregate Lloyd’s of London market. The peaks from the previous chart are matched by troughs in this chart for the same reasons.

A further reason for the similarity in returns is the capital efficiency of both Lloyd’s of London and specialty (re)insurance companies. Neither Lloyd’s of London businesses nor specialty (re)insurance companies tend to retain capital on the balance sheet that won’t be used to support future underwriting in the short term. Over time, significant use is made of dividends, special dividends and/or share buy-backs.

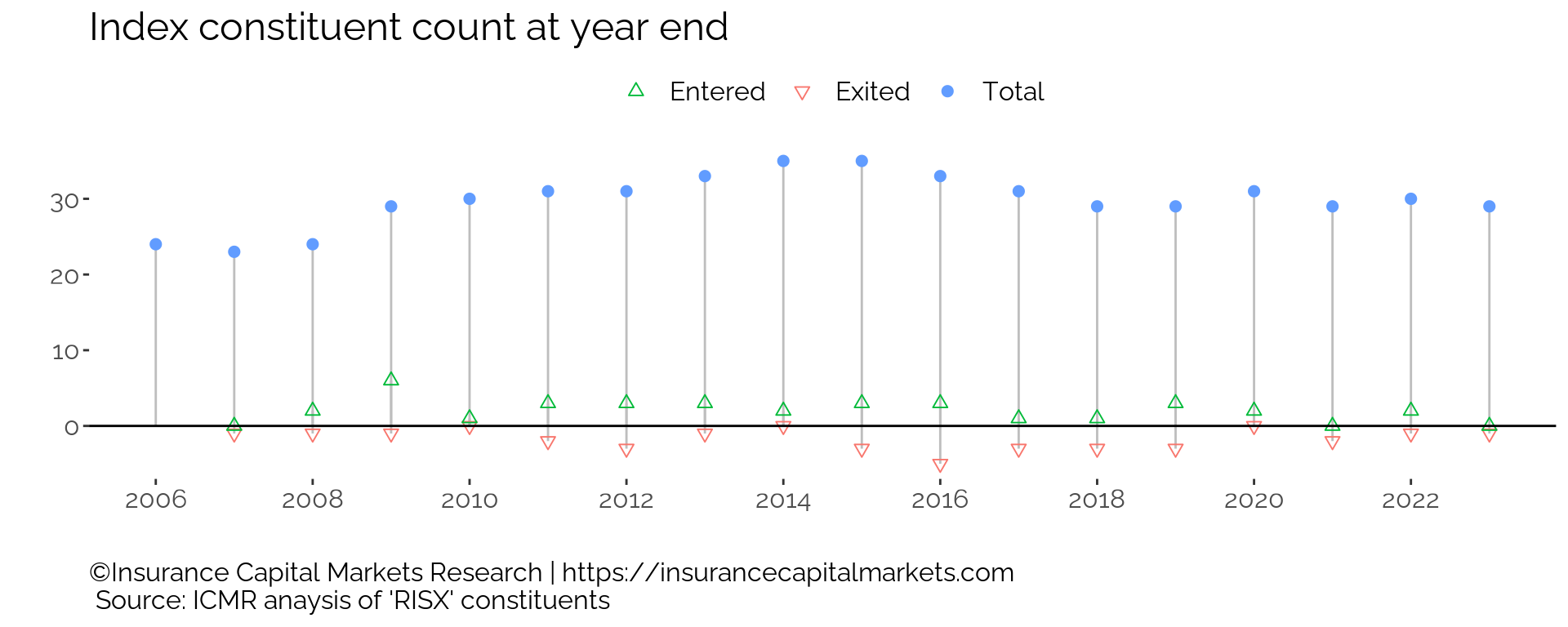

Churn within the RISX index over time has typically occurred where a constituent company has either sold their Lloyd’s business, either to another constituent company or via a take-private transaction (eg an MBO or private equity acquisition) or where a previously private Lloyd’s business has been acquired by a listed specialty (re)insurance company. The following chart shows how the total number of constituents in the RISX index has evolved over the course of the backtest.

Currently, over ⅔ of Lloyd’s of London’s capital is provided by companies represented in the RISX index. These companies’ Lloyd’s subsidiaries also account for over ⅔ of Lloyd’s total underwriting premium.

Methodology

The RISX index has been created as a tradable equity index. Constituents are weighted by trailing net premium, adjusted where necessary to ensure the tradability of each underlying constituent when traded as part of an index portfolio trade.

The methodology uses triple relative weighting; constituent companies relative to each other, constituent companies relative to their owned syndicates and, finally, syndicates relative to the Lloyd’s market aggregate. The result is that those constituent companies which trade predominantly through their Lloyd’s subsidiaries will have higher weightings compared to those for whom their Lloyd’s subsidiaries are incidental to their global premium volume. Thus, the RISX index is not based on market capitalisation.

The index is reviewed quarterly—in March, June, September and December—with the objective of reflecting change in the underlying ownership and control of businesses in the Lloyd’s of London market in a timely manner, while limiting undue index turnover. The RISX index is owned and provided by IC Capital Markets Ltd and is administered, calculated and distributed by Morningstar Indexes. The index is designed to be compliant with both the IOSCO Principles for Financial Benchmarks and the UK and EU Benchmarks Regulations.

Mornigstar Indexes is regulated by the Financial Conduct Authority as a registered benchmark administrator under the UK Benchmarks Regulation and by BaFin as a registered benchmark administrator under the EU Benchmarks Regulation.

Governance of the index is provided through the Mornigstar Index Management Committee, which is responsible for the management and implementation of the methodology rules, their continuing fitness for purpose and any periodic amendments thereto. It is also responsible, in the event of the rules not providing a clear process for the management of any situation, for determining the process to be followed.

Conclusion

- The RISX index creates the world’s first specialty (re)insurance equity index and is a real time equity benchmark for investments in the Lloyd’s of London insurance market

- The index represents a diversified universe of global listed companies that underwrite specialty (re)insurance risks

- Specialty (re)insurers’ earnings depend by and large on the fortuitous nature of claims (e.g. hurricanes or earthquakes), making it a diversifying asset within a portfolio

- Climate change is a key focus of specialty (re)insurance

- Almost all specialty (re)insurers and Lloyd’s have set targets for responsible underwriting and investment to help accelerate society’s transition from fossil fuel dependency towards renewable energy sources, as part of their ESG commitments

- The global specialty (re)insurance industry is a highly regulated industry and is reliant on maintaining superior financial strength ratings across all the key rating agencies

- The index offers an alternative benchmark for specialty (re)insurance-driven results that is more targeted than existing generalist insurance equity indices

- Two versions of the index are calculated daily, a price return index (ticker: ‘RISX’) and a net total return index (ticker: ‘RISXNTR’)

Licensing

For information about licensing the RISX index, please contact:

About ICMR

Insurance Capital Markets Research (ICMR, the trading name of IC Markets Research Ltd), is a specialist analytic and consulting firm.

We provide quantitative research on the global specialty (re)insurance industry. Our clients are insurance carriers, intermediaries and investors.

One of our core capabilities is the independent assessment of performance and return profiles of insurance entities and portfolios, both within Lloyd’s and globally. Our research focuses on investment strategies and the development of products to access the global specialty (re)insurance industry and Lloyd’s of London in particular.

Our founders were Lloyd’s former heads of analysis and research who also worked together in the capital markets and ILS. ICMR was established in early 2020 and launched the RISX Index in 2021: www.risxindex.com.

About Morningstar Indexes

Morningstar Indexes was built to keep up with the evolving needs of investors—and to be a leading-edge advocate for them. Our rich heritage as a transparent, investor-focused leader in data and research uniquely equips us to support individuals, institutions, wealth managers and advisors in navigating investment opportunities across major asset classes, styles, and strategies. From traditional benchmarks and unique IP-driven indexes to index design, calculation and distribution services, our solutions span an investment landscape as diverse as investors themselves

Disclaimer

This document was prepared by Insurance Capital Markets Research (ICMR, the trading name of IC Markets Research Ltd), including all statistical tables, charts, graphs or other illustrations contained herein, unless otherwise noted. ICMR is not a legal, tax or accounting adviser and makes no representation as to the accuracy or completeness of any data or information gathered or prepared by ICMR and contained in this document.

ICMR is not an investment advisor. ICMR is not regulated by the Financial Services Authority.

ICMR does not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any ICMR publications. You acknowledge that you use the information ICMR provides at your own risk. ICMR publications do not offer investment advice and nothing in them should be construed as investment advice. You should always carry out your own independent verification of facts and data before making any investment decisions.

This document is not intended to provide the sole basis for any evaluation by you of any transaction, security or instrument. The data and analysis provided by ICMR herein or in connection herewith are provided “as is”, without warranty of any kind whether expressed or implied. In no event will ICMR be liable for loss of profits or any other indirect, special, incidental and/or consequential damage of any kind, howsoever incurred or designated, arising from any use of the analysis provided herein or in connection herewith. The results presented herein are subject to significant variability. Any opinions that ICMR publishes may be wrong and may change at any time.

The information contained in ICMR publications is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any securities. ICMR publications are not, and should not be seen as, a recommendation to use any particular investment strategy.

Neither ICMR, nor Morningstar Indexes nor RISX are associated or affiliated in any way with Lloyd’s of London or the Society of Lloyd’s or the Corporation of Lloyd’s.